Tag: eSIM

iBASIS and Nordic blow away any question marks on eSIM NB-IoT and LTE-M technology with massive successful field-testing across 24 countries

A single iBASIS eSIM enables Nordic’s nRF9160 multi-mode NB-IoT/LTE-M SiP and Nordic Thingy:91 rapid prototyping platform.

iBASIS Chosen by Simfony for Global eSIM Connectivity Solutions

Selection follows two-year analysis of best capabilities in the eUICC market Integrated in Q2, traffic and usage rapidly growing across verticals Simfony MVNO customers enabled

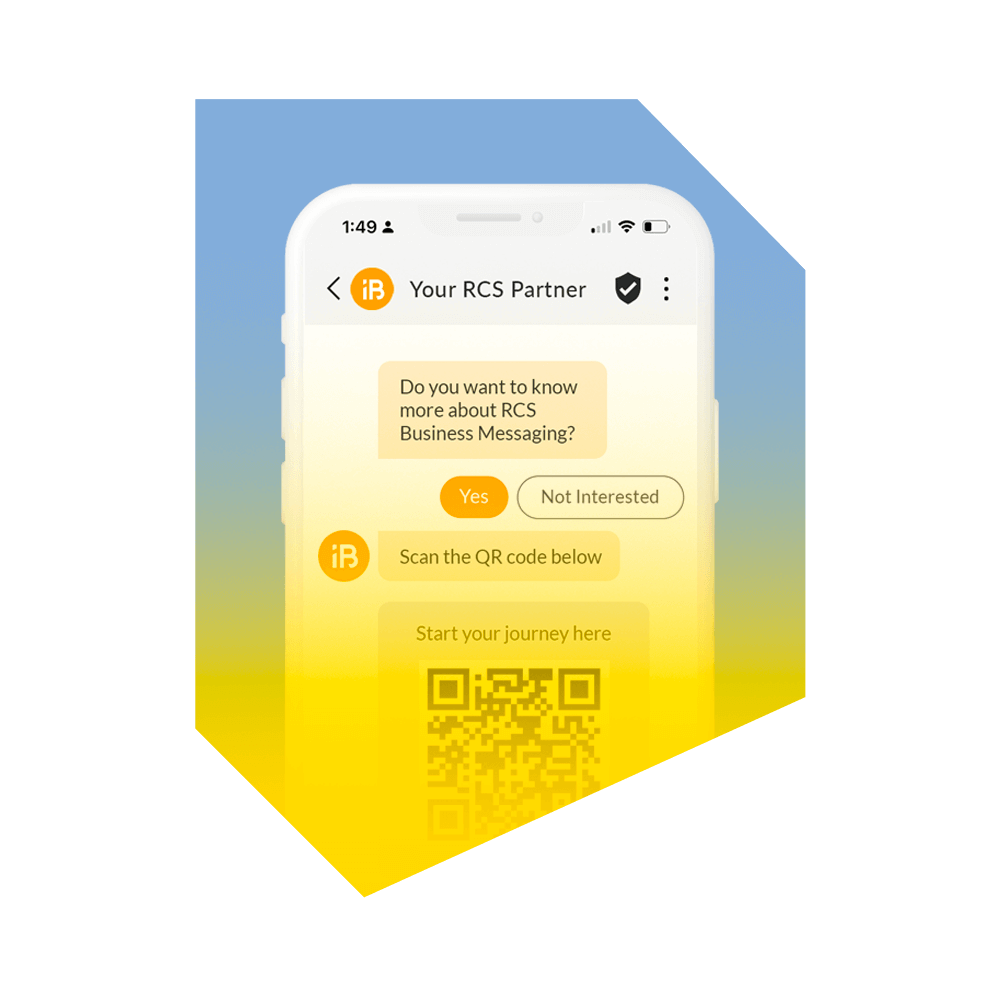

The Next Generation SIM and How It Works

Internet of Things providers who offer a ‘thing’ and a paired thing service will often deploy their globally delivered or traveling smart devices with a

Enterprise Mobility: A New Age is Coming – Part I

Enterprise Mobility Today Is texting via SMS becoming a thing of the past? It seems that calling with our phones or messaging using SMS/MMS on

eSIM Enabling a Next Generation of Roaming Opportunities

Bilateral versus Unilateral Roaming Relationships Traditionally roaming is commercially settled based on bilateral roaming relationships between mobile network operators with the basic goal to enable

eSIM Standardization Efforts

The GSMA Association and the eSIM The GSM Association is a trade body that represents the interests of mobile network operators worldwide. Approximately 800 mobile

Solving The IoT Challenges of Mobile Network Operators (MNOs)

Mobile Network Operators (MNOs) are the owners of a key asset required to connect wide area high bandwidth Internet of Things (IoT) devices – the